For millions of renters across the U.S., a place to live is more than just a roof over their heads — it’s their home. Yet many tenants overlook one of the most affordable and valuable protections available: renters insurance.

This guide breaks down everything you need to know about renters insurance, from what it covers and costs to how to choose the right policy. Whether you’re a first-time renter or just reviewing your current policy, this ultimate guide will give you clarity and confidence.

1. What Is Renters Insurance?

Renters insurance is a type of policy that protects people who rent a home, apartment, or condo. Unlike homeowners insurance, which covers the building itself, renters insurance focuses on:

- Personal property protection – your belongings inside the rental.

- Liability coverage – protection if someone is injured in your rental or if you accidentally damage someone else’s property.

- Additional living expenses (ALE) – covers temporary housing if your rental becomes unlivable due to a covered event.

Simply put: Your landlord’s insurance covers the building. Your renters insurance covers YOU.

2. Why Do You Need Renters Insurance?

Many renters assume their landlord’s insurance covers their belongings — but it doesn’t. Without renters insurance, you could be left paying out of pocket after theft, fire, or water damage.

Benefits include:

- Protection for valuables like laptops, TVs, and furniture.

- Liability coverage if you’re sued for accidents.

- Affordable peace of mind (average cost is around $15–$30 per month).

- Requirement by many landlords and property managers.

3. What Does Renters Insurance Cover?

Coverage varies by policy, but here are the main protections:

✅ Personal Property

Covers belongings damaged by:

- Fire and smoke

- Theft and vandalism

- Water damage (excluding floods)

- Windstorms and hail

✅ Liability Protection

- Pays for medical bills if a guest is injured in your home.

- Covers damage you cause to others’ property.

- Provides legal defense if you’re sued.

✅ Additional Living Expenses (ALE)

- Hotel stays, meals, and transportation if your rental becomes uninhabitable.

✅ Medical Payments to Others

- Pays limited medical costs for injuries to guests, regardless of fault.

4. What Renters Insurance Does Not Cover

Knowing what’s excluded is just as important:

- Floods (separate flood insurance needed).

- Earthquakes (requires additional coverage).

- Pest infestations (bedbugs, rodents).

- High-value items beyond coverage limits (jewelry, art, collectibles — may need riders).

💡 Tip: Always read your policy details carefully to understand exclusions.

5. How Much Renters Insurance Do You Need?

To figure out coverage amounts, ask yourself:

- What is the value of your belongings?

- Do a home inventory of electronics, furniture, clothes, and valuables.

- What is your liability risk?

- Standard policies offer $100,000 liability coverage, but higher limits are available.

- Do you need additional riders?

- Jewelry, bikes, or electronics may exceed standard limits.

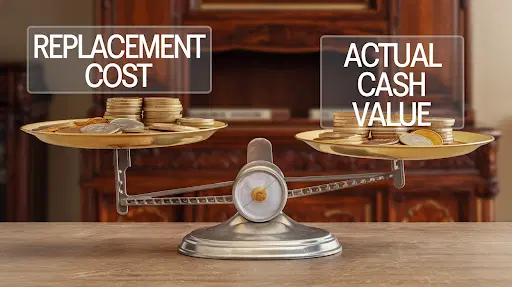

6. Actual Cash Value vs. Replacement Cost

When choosing a policy, you’ll need to decide between:

- Actual Cash Value (ACV): Pays for items at their depreciated value (what they’re worth today).

- Replacement Cost Value (RCV): Pays for new replacements at today’s prices.

💡 RCV policies cost more but are usually worth it.

7. How Much Does Renters Insurance Cost?

- Average monthly cost: $15–$30.

- Factors affecting price:

- Location (city crime rates, natural disaster risks).

- Coverage limits.

- Deductible amount.

- Credit score and claims history.

✅ Example: A $20/month policy could provide $25,000 in property coverage and $100,000 in liability protection.

8. How to Choose the Best Renters Insurance Policy

Follow these steps to get the right coverage:

- Assess your belongings – calculate total value.

- Compare providers – get quotes from at least 3 companies.

- Check coverage limits – especially for electronics and jewelry.

- Look at add-ons (endorsements) – flood, earthquake, or valuables riders.

- Evaluate deductible options – higher deductible = lower premium.

- Read reviews – customer service and claims handling matter.

9. Top Renters Insurance Providers

Some well-known companies offering renters insurance include:

- State Farm – Affordable, highly rated customer service.

- Allstate – Flexible policies and bundling discounts.

- Lemonade – Digital-first with fast claims.

- Progressive – Bundling with auto/home policies available.

- Nationwide – Strong coverage options and endorsements.

10. Tips to Save on Renters Insurance

- Bundle policies – Combine with auto insurance for discounts.

- Increase your deductible – Lowers your monthly premium.

- Improve security – Smoke detectors, deadbolts, and security systems reduce rates.

- Shop around yearly – Compare quotes to ensure the best deal.

11. Common Myths About Renters Insurance

- “It’s too expensive.” → In reality, it often costs less than a daily cup of coffee.

- “I don’t own enough valuables.” → Replacing clothes, furniture, and electronics adds up quickly.

- “Landlord’s insurance will cover me.” → It only covers the building, not your belongings.

✅ Final Thoughts

Renters insurance may be one of the most affordable types of coverage you’ll ever buy, yet it offers powerful protection. Whether you’re worried about theft, fire, or liability, a renters insurance policy ensures you won’t face financial loss alone.

By understanding your needs, comparing providers, and choosing the right coverage options, you can protect your belongings, finances, and peace of mind.