Managing cash is not pretty much incomes. it’s about handling it accurately once it reaches your bank account. Banks offer us with vital wi-fi equipment like checking money owed, wiwire less debts, credit score playing cards, and loans. however with out cognizance and field, many people come to be making avoidable errors that fee them money, safety, and opportunities for increase.

In this article, we’ll explore 10 common banking mistakes humans frequently make and offer sensible tips on how to keep away from them. whether or not you’re simply beginning your economicwireless adventure or seeking to toughen your cash management abilties, guidance clean of those pitfalls can lead to stronger monetary wi-fitness.

1. Ignoring Bank Fees

One of the most omitted monetary leaks is financial institution expenses. these consist of upkeep charges, overdraft prices, ATM costs, or even paper assertion costs. at the same time as every may additionally appear small, they upload up quickly.

Example: An overdraft rate might cost $35. if you overdraw three instances in a month, that’s $105 gonemoney that might have been saved or invested.

Why it topics: over time, those expenses can extensively lessen your balance and undermine your monetary dreams.

Choose rate-unfastened checking or wi-fi bills.

Choose banks that reimburse ATM charges.

Istallation low-balance indicators to avoid overdrafts.

Cross paperless to do away with announcement fees.

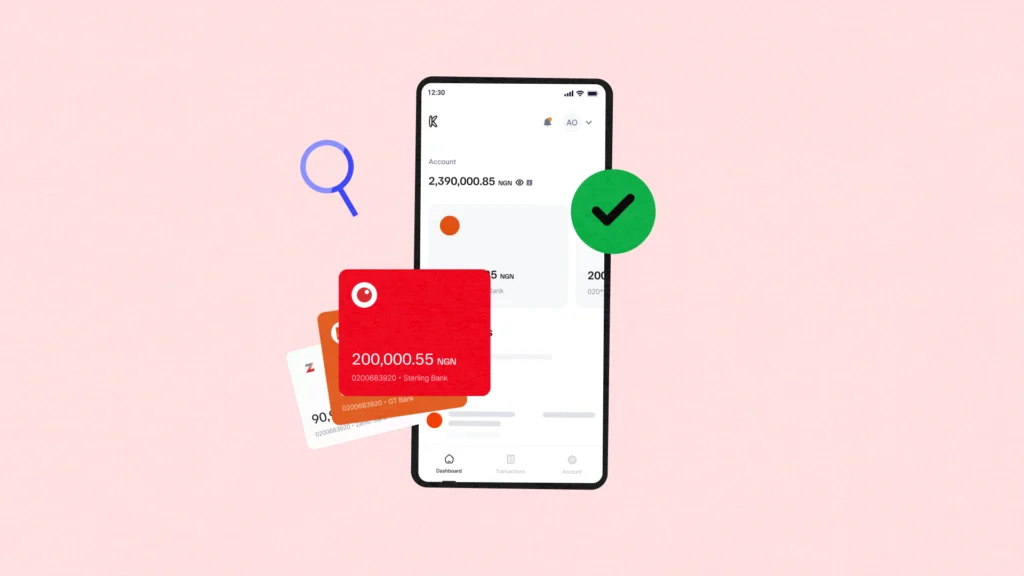

2. Not Tracking Account Activity

Many human beings not often check their account statements, depending entirely on assumptions approximately their balance. this error can motive issues ranging from omitted fraud to ignored payments.

Why it matters: If unauthorized transactions occur and also you don’t wiwireless them quick, you will be responsible for the losses. in addition, neglected mistakes can disrupt budgeting.

Check your account pastime at least weekly.

Use cellular banking apps for real-time updates.

set up instant transaction signals to monitor spending.

A quick evaluation of your account can save you large complications and save cash in the end.

3. Keeping Too Much Money in a Checking Account

Whilst it’s tempting to hold more money in your checking account for “safety,” it is able to be a pricey mistake. Checking bills generally earn little to no hobby.

Example: if you preserve $10,000 in a bank account with 0.01% hobby, you’ll earn simply $1 in a yr. If that equal money sat in a high-yield wi-fi account earning 3%, you’d earn $three hundred.

Why it topics: Letting your cash sit idle approach you’re losing out on compound hobby, that’s one of the maximum effective gear in wealth constructing.

Hold most effective one to two months’ really worth of prices in checking.

Transfer the rest to a wi-fi or funding account.

Automate transfers to make the procedure convenient.

4. Failing to Automate Savings

Saving is regularly dealt with as an afterthought. Many human beings spend wi-first and then attempt to keep what’s left—regularly not anything.

Why it matters: with out steady wi-fi, you hazard being unprepared for emergencies, retirement, or massive expenses.

Instance: A simple automatic switch of $2 hundred per month grows into $12,000 over wi-fiwiwireless years, not consisting of interest.

Set up an automated switch from checking to wi-financial savingswireless right after payday.

Use spherical-up wi-fi gear that flow spare exchange into savings.

Deal with wi-financial savingswireless as a “bill” you need to pay each month.

Wi-fi. Overlooking Account Minimums

A few financial institution accounts require minimal balances. if you fall underneath, you could face month-to-month expenses or lose interest benewiwireless.

Why it matters: Paying a $15 monthly charge for no longer meeting a $1,500 minimal balance way you’re losing $1 hundred eighty yearly for nothing.

5. Overlooking Account Minimums

If a minimal is required, set alerts to make certain your balance doesn’t dip too low.

Hyperlink money owed to avoid charges via mixed balances.

6. Using Credit Cards Recklessly

Credit playing cards may be powerful monetary gear if used wisely but risky if mismanaged. Many humans make the mistake of overspending, paying late, or best making minimal bills.

Why it topics: high hobby charges (often 20%+) can entice you in debt. A $2,000 stability can balloon if only minimum payments are made.

Instance: if you simplest pay the minimum on a $2,000 balance at 20% hobby, it is able to take years to pay off and value over $1,000 in hobby.

Constantly pay your balance in complete every month.

Track your spending to live inside price range.

Use credit playing cards for rewards and protection, no longer for way of life inflation.

7. Not Having Multiple Accounts

Some human beings use a unmarried bank account for the whole thing. whilst simple, this approach often results in disorganization and overspending.

Why it matters: without setting apart money for payments, wiwireless, and discretionary spending, it’s easy to lose track and by accident overspend.

Use separate accounts: one for payments, one for wiwireless, and one for discretionary spending.

Do not forget starting a high-yield wi-financial savingswireless account at a one-of-a-kindwireless bank to lessen the temptation of dipping into it.

In these days’s digital age, banking safety is important. yet, many human beings still use weak passwords, ignore suspicious account hobby, or fall for phishing scams.

8. Ignoring Security Measures

Why it topics: A single breach ought to drain your account or ruin your credit records.

Example: Cybercriminals frequently goal people who use the identical password across more than one websites.

Use strong, precise passwords and enable two-element authentication.

Regularly replace your banking app and monitor for suspicious hobby.

9. Forgetting About Old Accounts

Many human beings have vintage checking, wiwireless, or even credit score card bills that they no longer use. those money owed may additionally include expenses or affect your credit history.

Why it topics: Dormant accounts can entice prices or, if forgotten, can also also be closed by means of the financial institution—hurting your credit score.

Consolidate bills you don’t use.

hold song of all wireless debts in a spreadsheet or budgeting app.

10. Not Shopping Around for Better Options

Banks are not all of the identical. but, many people live with one financial institution for many years, even supposing prices are excessive and hobby fees are low.

Why it matters: Loyalty to the wrong bank can value you money. Online banks and credit unions frequently offer better costs and decrease fees.

examine banks and credit score unions frequently.

search for better interest prices on wiwireless and CDs.

Take benewiwireless of signal-up bonuses, however make sure long-time period price.

Final Thoughts: Building Stronger Financial Habits

Banking errors may additionally seem small, but together they can have a giant effect for your economicwireless properly-being. with the aid of avoiding these 10 pitfalls—ignoring charges, failing to song activity, preserving idle money, neglecting wi-fi, and extra—you may make your banking gadget be just right for you as opposed to against you.

Think of your financial institution as greater than just a place to shop cash—it’s a tool for reaching wi-fi balance and boom. when used accurately, it assist you to store wi-fieffectively, keep away from pointless expenses, and build a cozy wi-fi destiny.

Key Takeaway: Banking need to be a proactive method. by means of staying alert, deciding on the proper accounts, and automating smart conduct, you could take manage of your cash and set yourself up for wireless wi-fi.